Cused car loan calc download#

There\’s a lot to learn before buying a new or used car, and Mission Fed\’s Auto Loan Guide is here to help! Download the free guide online and get answers to these questions and more: We can’t wait to serve you! Get the Mission Fed Auto Loan Guide Let our Car Loan calculator get you started on the right foot, and then explore our Auto Loan options. Your success is our bottom line, and that includes buying your next car. With our bottom line rates on Auto Loans and the option of buying your car through Autoland, Mission Fed is happy to help make your car buying experience as wonderful as your car-driving experience. Our Auto Loan calculator can help you figure out how much car you can afford and estimate your car payment before you sign the dotted line on your new or pre-owned car. Mission Federal Credit Union offers a variety of tools to help you get a great car at a great price. Your representative then negotiates the deal for you and delivers your car to you at your local Mission Fed branch. Once you have your Mission Fed Auto Loan in hand, you can request a dedicated Autoland representative to find the car that you want from their wide network of partner dealerships. With an Auto Loan from Mission Fed and car buying service from Autoland, you can get the car you want delivered straight to you. With Mission Fed, you can also enjoy getting a new or pre-owned car without ever setting foot in a dealership. Mission Fed offers great rates and loanterms that can help your budget now and in the long run for your monthly payments. Once you’ve familiarized yourself with your price range, explore your options with Mission Fed to secure an Auto Loan with Mission Fed Bottom Line Rates, which may save you money when compared to auto financing with a car dealer or another lender. Not all auto loans are created equal, due to different financing terms. How can our Car Loan calculator help you choose the right auto loan? Use the Car Loan calculator to get a sense of what kind of car, auto loan and price range you should shop for. Once you’ve entered all the information into our Car Loan calculator, you’ll be able to see what you\’re likely to pay for your monthly payments and how much it will ultimately cost you over the life of the loan.

Cused car loan calc registration#

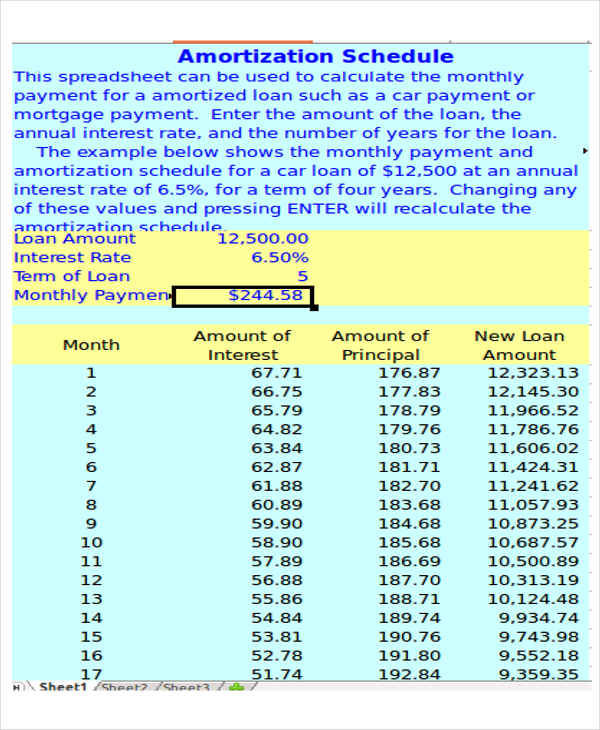

The Auto Payment calculator allows you to enter the length of the loan, the down payment amount, the loan APR and the vehicle purchase price, as well as the sales tax, trade-in value and title and registration costs. With our Auto Loan calculator, you can adjust a variety of variables for the most accurate estimate.

Interest Rate: The Annual Percentage Rate on your loan can vary depending on your credit score and other qualifications.Down payment: What amount can you afford to put down in cash towards the purchase price.Loan amount: How much will you need to borrow.Trade-In: If you are planning to trade-in a vehicle, you’ll need to know the value of the vehicle and how much you owe on the vehicle.Title and Registration Costs: Title and registration fees for your state can depend on many factors including the type of car, year, state, # of axles, etc.Rebate: Rebates offered by the car dealer, if any.Sales Tax Percentage: The automobile sales tax rate, which varies by state and city.To figure out all the costs, you’ll need to know: This Auto Finance Calculator also allows you to calculate your monthly car payments over the life of the loan. Our Car Loan Payment Calculator can help you estimate the total cost of your auto purchase so that you can see how much you can afford based on your current finances. So, how can you budget for these costs and what are your financing options? There can be costs beyond the purchase price to consider, such as sales tax, title and interest rates on your loan. Use our Car Finance calculator to help you buy smartīefore you start shopping for a new or used car, it helps to familiarize yourself with your monthly budget and what costs you should be prepared for.

0 kommentar(er)

0 kommentar(er)